If you’re a business looking for a payment processing solution, the onboarding process can feel like a hurdle. Lengthy forms, confusing instructions, and long waiting periods slow down your ability to start accepting payments. Every delay can mean lost revenue, frustrated customers, and a stressful start to your partnership with a provider.

The good news? Merchant onboarding doesn’t have to be complicated. Visa analysis shows that top-performing providers now offer onboarding that can be completed in as few as eight steps and in under one minute. Meanwhile, the same process can take traditional acquirers days if not weeks to complete.

With the right payment processing software, you can move from application to approval quickly, securely, and with minimal effort. At Maayan, we’ve designed our onboarding to get you selling faster, with less effort and zero guesswork.

Why merchant onboarding matters for your business

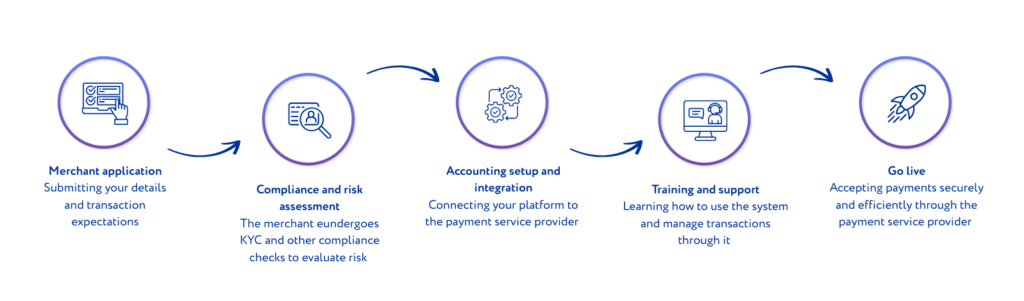

Onboarding is more than just paperwork – it’s the first step in your payments journey. Here’s what the process typically involves:

- Merchant application: Submitting your details and transaction expectations

- Compliance and risk assessment: The merchant undergoes KYC and other compliance checks to evaluate risk

- Accounting setup and integration: Connecting your platform to the payment service provider

- Training and support: Learning how to use the system and manage transactions through it

- Go live: Accepting payments securely and efficiently through the payment service provider

When merchant onboarding becomes slow or confusing, it can disrupt your business in several ways:

- Lost revenue: Every day your account isn’t approved is a day you can’t accept payments.

- Frustration and uncertainty: Repeated requests for documents or unclear instructions create unnecessary stress.

- Integration headaches: Complicated setup with eCommerce platforms or POS systems can delay your ability to sell.

By contrast, fast, secure, and intuitive onboarding lets you get up and running quickly and start selling with confidence.

When automation is used to handle time-consuming steps like identity checks, document verification, and risk scoring, information is validated instantly using trusted data sources.

This keeps the process both fast and compliant. KYC/KYB checks, sanctions screening, and fraud detection tools run quietly in the background, ensuring regulatory requirements are met without adding friction.

The result: quicker approvals, fewer delays, and a smoother start to your payments journey.

What makes a merchant-friendly onboarding process?

Data from Mastercard reveals that smooth and efficient onboarding is a top priority for merchants today. Thirty-six percent value a simple application process, while 30% emphasize onboarding speed when choosing an eCommerce payment solution.

To ensure you choose a provider that offers a smooth and efficient onboarding experience, ask the following questions when evaluating the options:

- Will I be able to complete the application quickly without confusion?

- Will I get clear updates and guidance throughout the process?

- Will security and fraud prevention be handled efficiently?

- What kind of support will the provider offer if I need help?

It’s also important to look out for the hallmarks of a strong, merchant-first onboarding process:

1. Speed and efficiency

Look for a provider that offers a quick, digital application with automated verification and instant identity checks. This reduces waiting times and helps you start accepting payments sooner.

2. Clarity and guidance

A good provider makes each step clear—what documents are required, how long each stage takes, and where to go if you need support. Transparent, step-by-step guidance helps prevent delays.

3. Security and fraud prevention

Strong onboarding includes built-in compliance and fraud protection from day one. Real-time risk scoring, automated KYC/KYB checks, and secure data handling help protect your business without creating extra friction.

4. Support when you need it

Even the best onboarding flows benefit from accessible support. Whether through live chat, documentation, or hands-on guidance, you should feel confident that help is there if you need it.

How Maayan’s onboarding gets you selling sooner

At Maayan, we’ve designed a merchant onboarding experience that balances speed, security, and simplicity:

- Simple digital pre-application forms: Fill out your information quickly without confusing paperwork.

- Automated KYC/KYB checks: Verify your identity and business details.

- Smart risk tools: Fast approvals for low-risk merchants, while complex cases get careful attention.

- Transparent updates: Keep track of your application status at every step, with guidance and support if needed.

At Maayan, we combine automation with optional hands-on support designed to help you solve challenges quickly and confidently.

Merchant onboarding: the future is frictionless

Merchant onboarding doesn’t have to be complicated or slow. With the right provider, you can move from application to approval quickly, securely, and with minimal effort.

As a direct acquirer, Maayan provides an onboarding experience that combines automation, clear workflows, and expert support.

Whether you’re just starting or expanding globally, choosing a payment provider that prioritizes a fast, secure, and intuitive onboarding process will help you get up and running quickly – and start selling sooner.

To learn more, explore Maayan’s solutions for merchants.